See? 18+ Truths On Tight Money Policy Is They Missed to Share You.

Tight Money Policy Is | The apex bank said that it would maintain its tight money policy throughout 2019. Together, the requisite tight money policies and fiscal restraint necessary to attract global capital have effects that are potentially contradictory to those caused by capital flows. Tight money policy is a monetary policy which is undertaken to address inflation, with the goal of slowing the rate of inflation so that it does not climb out of control. Tight money policy, dear money policy, hawkish money policy. What is easy money policy, cheap money policy, dovish money policy vs.

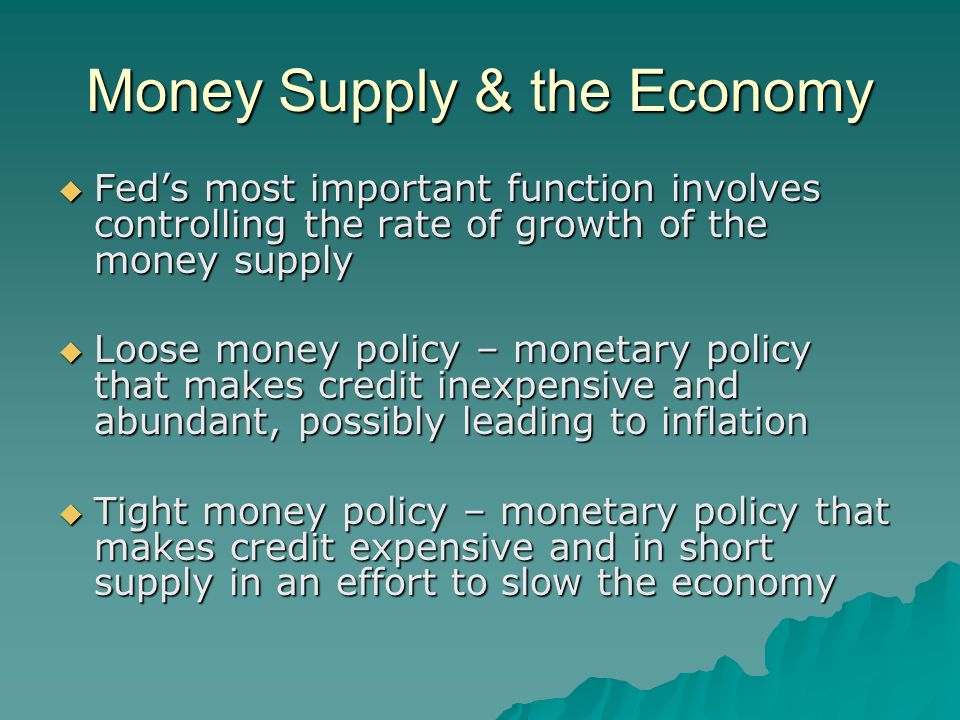

Tight money policy, dear money policy, hawkish money policy. Monetary policy is the branch of financial policy that is concerned of controlling the supply of money and credit. Tight monetary policy tight monetary policy implies the central bank (or authority in charge of monetary policy) is seeking to reduce the demand for money and limit the pace of economic expansion. Attributing economic slowdown to reserve bank's tight money policy and global financial problems, finance minister pranab mukherjee today said pointing out that global factors and tight monetary policy of the rbi slowed down growth, mukherjee said, i expect this slowdown to be temporary and. Tight money policy is a monetary policy which is undertaken to address inflation, with the goal of slowing the rate of inflation so that it does not climb out of control.

Attributing economic slowdown to reserve bank's tight money policy and global financial problems, finance minister pranab mukherjee today said pointing out that global factors and tight monetary policy of the rbi slowed down growth, mukherjee said, i expect this slowdown to be temporary and. If government pursues a tight monetary policy, it restricts the amount of money in circulation and reduces the funds available banks for making loans. In the celebrated paper some unpleasant monetarist arithmetic, sargent and wallace (1981) show that tight monetary policy is not feasible unless it is supported by appropriate fiscal adjustment. Designed to counteract the effects of inflation and return economy to full employment. This can also be accomplished in a. (redirected from tight money policy). . policies and the adoption of tight money policies, and partly due to sluggish . realising the challenges in the monetary sphere, we expect the national bank to adhere to a reasonable tight policy, trying to anchor and lower the expectations through enhancing stability at the money market. Tight monetary policy suggests the central bank (or specialist responsible for monetary policy) is trying to decrease the interest for cash and limit the pace of monetary extension. A policy in which a central monetary authority, for example, the federal reserve system, seeks to restrict credit and raise interest rates. The apex bank said that it would maintain its tight money policy throughout 2019. So, an apex bank would adopt various means and ways to withdraw excess money from economy by using tools such as increasing interest rates, selling securities in open. Tight money policy, dear money policy, hawkish money policy. Tight money policy is monetary policy that reduces the money supply.

It is worth noting that it is the central bank note that tight or restrictive money policy is one which reduces the availability of credit and also raises its cost. Usually, this involves increasing interest rates. Tight monetary policy is an action undertaken by a central bank such as the federal reserve to slow down overheated economic growth. Tight money policy, dear money policy, hawkish money policy. Together, the requisite tight money policies and fiscal restraint necessary to attract global capital have effects that are potentially contradictory to those caused by capital flows.

Tight money policy is monetary policy that reduces the money supply. Together, the requisite tight money policies and fiscal restraint necessary to attract global capital have effects that are potentially contradictory to those caused by capital flows. The apex bank said that it would maintain its tight money policy throughout 2019. Monetary policy is another important instrument with which objectives of macroeconomic policy can be achieved. This can also be accomplished in a. (redirected from tight money policy). It is worth noting that it is the central bank note that tight or restrictive money policy is one which reduces the availability of credit and also raises its cost. Tight monetary policy is an action undertaken by a central bank such as the federal reserve to slow down overheated economic growth. Monetary policy is the management or political maneuvering of the nation's economy. Decreases in the supply of money eventually. Attributing economic slowdown to reserve bank's tight money policy and global financial problems, finance minister pranab mukherjee today said pointing out that global factors and tight monetary policy of the rbi slowed down growth, mukherjee said, i expect this slowdown to be temporary and. A tight monetary policy refers to central bank policy aimed at cooling down an overheated economy and features higher interest rates and tighter money supply. Monetary policy, at best, is a blunt instrument, a tight policy particularly so given the hardships that it tends to inflict on many.

The reduction is available credit is viewed an acceptable tradeoff when compared with the consequences of long term runaway inflation. Easy and tight money are states based on the policies of the federal reserve bank. . policies and the adoption of tight money policies, and partly due to sluggish . realising the challenges in the monetary sphere, we expect the national bank to adhere to a reasonable tight policy, trying to anchor and lower the expectations through enhancing stability at the money market. Together, the requisite tight money policies and fiscal restraint necessary to attract global capital have effects that are potentially contradictory to those caused by capital flows. The apex bank said that it would maintain its tight money policy throughout 2019.

Easy and tight money are states based on the policies of the federal reserve bank. Decreases in the supply of money eventually. Monetary policy is the branch of financial policy that is concerned of controlling the supply of money and credit. Tight money policy is a monetary policy which is undertaken to address inflation, with the goal of slowing the rate of inflation so that it does not climb out of control. If on the other hand, the fed pursues the opposite course of action because it fears inflation—in other words, if it raises interest rates and reserve requirements, and sells bonds—we say that the fed has adopted tight money policies. Monetary policy, at best, is a blunt instrument, a tight policy particularly so given the hardships that it tends to inflict on many. Tight monetary policy tight monetary policy implies the central bank (or authority in charge of monetary policy) is seeking to reduce the demand for money and limit the pace of economic expansion. Tight monetary policy suggests the central bank (or specialist responsible for monetary policy) is trying to decrease the interest for cash and limit the pace of monetary extension. A tight monetary policy refers to central bank policy aimed at cooling down an overheated economy and features higher interest rates and tighter money supply. What is easy money policy, cheap money policy, dovish money policy vs. In the united states, the federal reserve is raising the discount and prime interest rates creates a tight economic environment where the supply of money decreases. When monetary policy is easy, the fed is trying to tight money is when the bank decides there is too much money in the economy, and acts to remove some of it. Tight money policy is monetary policy that reduces the money supply.

Tight Money Policy Is: Policy — c mediumvioletred (as used in expressions) big stick policy fiscal policy foreign policy good neighbour policy incomes policy monetary policy …

Source: Tight Money Policy Is

0 Response to "See? 18+ Truths On Tight Money Policy Is They Missed to Share You."

Post a Comment